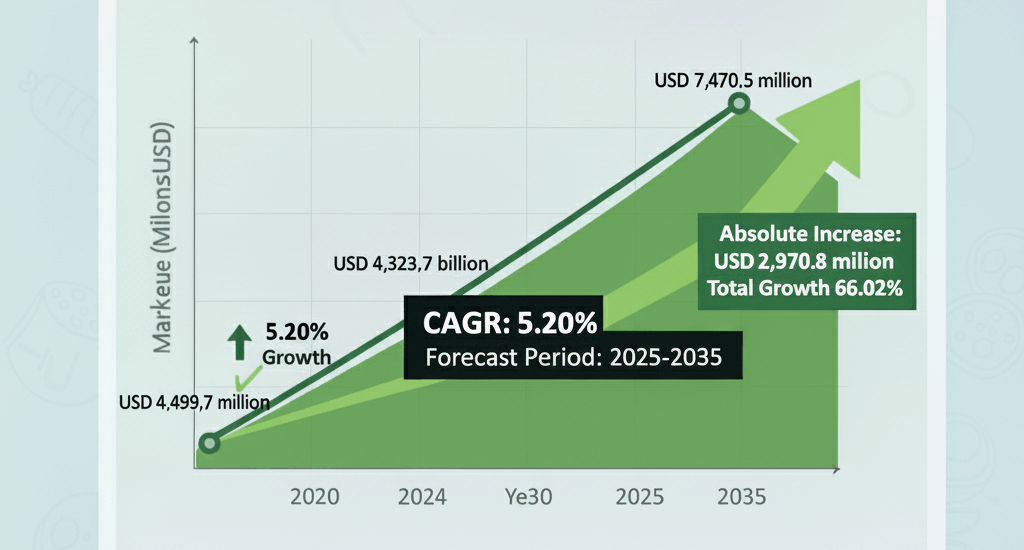

UV Coatings Market to Hit USD 7,470.5 Million by 2035 with 5.2% CAGR Analysis by Future Market Insights

Future Market Insights (FMI), a premier provider of market intelligence and consulting services, today unveiled its latest in-depth report titled “UV Coatings Market Size & Forecast 2025-2035.” The global UV coatings market is projected to experience substantial growth, driven by increasing demand for eco-friendly coatings, advancements in UV-curable technologies, and rising industrial applications. The market is estimated to be valued at USD 4,499.7 million in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.2%, reaching USD 7,470.5 million by 2035.The report underscores the market’s pivotal role in advancing sustainable, high-performance coating solutions amid tightening environmental regulations and technological innovations. As industries worldwide pivot toward eco-friendly alternatives, this study equips stakeholders with actionable insights to navigate emerging opportunities and drive strategic decisions in a rapidly evolving landscape.

UV Coatings Market Insights: Trends, Drivers, Challenges, Opportunities, and Competitive Landscape:

The UV coatings market is poised for robust growth, fueled by a confluence of environmental imperatives and technological breakthroughs. Key trends include the widespread adoption of UV LED curing systems, which offer enhanced energy efficiency, reduced operational costs, and faster curing times compared to traditional methods. The report highlights a shift toward bio-based and waterborne formulations, aligning with global sustainability goals and stringent volatile organic compound (VOC) regulations. Growth drivers are multifaceted: increasing demand for low-VOC, solvent-free coatings in sectors like automotive, electronics, and packaging; advancements in UV-curable technologies that enhance durability, scratch resistance, and aesthetic appeal; and the push for energy-efficient manufacturing processes.

However, the market faces notable challenges. High initial investment costs for specialized UV curing equipment pose barriers, particularly for small and medium-sized enterprises (SMEs). Fluctuations in raw material prices, driven by geopolitical tensions and supply chain disruptions, further strain profit margins. Despite these hurdles, opportunities abound. The rise of sustainable coatings, such as bio-based UV variants, presents a pathway to differentiate products and comply with evolving regulations. Innovations in UV LED technology are lowering entry barriers, enabling broader adoption across industries. The competitive landscape is dominated by global giants leveraging R&D and strategic acquisitions to maintain market share. AkzoNobel N.V. leads with 14-18% share, followed by PPG Industries Inc. (12-16%), BASF SE (10-14%), Axalta Coating Systems (8-12%), and Sherwin-Williams (6-10%). Regional players and niche innovators are carving out spaces by focusing on cost-effective, application-specific solutions, intensifying competition and fostering innovation.

UV Coatings Market Update: Latest Developments and Shifts:

The UV coatings sector has witnessed dynamic shifts from 2020 to 2024, transitioning into a transformative phase for 2025-2035. During the earlier period, the market emphasized recovery from pandemic-induced disruptions, with a surge in demand for rapid-curing, eco-friendly alternatives amid heightened regulatory scrutiny on solvent-based coatings. Technological advancements, such as improved UV LED systems and enhanced adhesion properties, propelled growth in automotive and electronics applications. Sustainability emerged as a core theme, with low-VOC formulations gaining traction in packaging and industrial coatings.

Looking ahead, the industry is gearing up for radical innovations. Nanotechnology integration, self-healing coatings, and AI-driven quality control are expected to redefine performance standards. The expansion into emerging applications like 3D printing, aerospace, and medical devices will unlock new revenue streams. Regulatory landscapes are tightening globally, with stricter mandates on bio-based and low-energy systems in Europe and North America. In Asia-Pacific, rapid industrialization in China, India, and Japan is accelerating adoption, though raw material volatility remains a concern.

Recent industry news underscores this momentum. In July 2024, PPG Industries launched its DuraNEXT™ portfolio of energy-curable coatings for coiled metal, incorporating UV and electron beam technologies to enhance durability and efficiency in industrial applications. This move reflects a broader trend toward versatile, eco-conscious solutions. Additionally, BASF SE announced expansions in sustainable UV formulations in early 2025, targeting automotive and packaging sectors to meet EU’s stringent VOC limits. These updates signal a market ripe for investment, with a focus on circular economy principles like biodegradable and recyclable coatings. FMI’s report analyzes these developments, providing a forward-looking view on how geopolitical factors, such as supply chain realignments post-2024 global events, will influence market trajectories.

UV Coatings Market Applications: Unlocking Value Across Sectors:

The FMI report illuminates how UV coatings deliver tangible benefits across diverse industries, enabling businesses to optimize operations, reduce environmental footprints, and enhance product quality. In the automotive sector, which is projected to dominate end-use segments, UV coatings provide superior scratch resistance, weatherproofing, and high-gloss finishes for exteriors, interiors, and protective layers—helping manufacturers comply with EPA and EU regulations while improving vehicle longevity and aesthetics.

Electronics manufacturers benefit from UV coatings’ chemical resistance and rapid curing, ideal for circuit boards, touchscreens, and optical devices, ensuring reliability in high-performance gadgets. The packaging industry leverages these coatings for durable, vibrant labels and boxes, enhancing shelf appeal and safety in food and beverage applications amid rising demand for smart packaging. Wood and furniture sectors gain from antibacterial, anti-scratch properties, extending product life and meeting consumer preferences for sustainable, high-gloss finishes.

In construction and industrial coatings, UV solutions support energy-efficient building materials and machinery protection, aligning with green infrastructure projects. For SMEs and large enterprises alike, the report’s insights facilitate cost-benefit analyses, such as transitioning to UV LED systems to cut energy costs by up to 50%. By segmenting the market by composition (monomers, oligomers like polyester and epoxy, photo initiators, additives), type (water-based, solvent-based), and end-use, the study empowers decision-makers to tailor strategies, forecast demand, and capitalize on regional trends—for instance, Asia-Pacific’s industrialization boom or North America’s innovation hubs.

Post time: Nov-08-2025